Manage Cash Flow Effectivity Via Power BI

Manage Cash Flow Effectivity Via Power BI

-

April 20, 2020

- Posted by: Content Editor

- Category: BI

No Comments

- April 20, 2020

- Posted by: Content Editor

- Category: BI

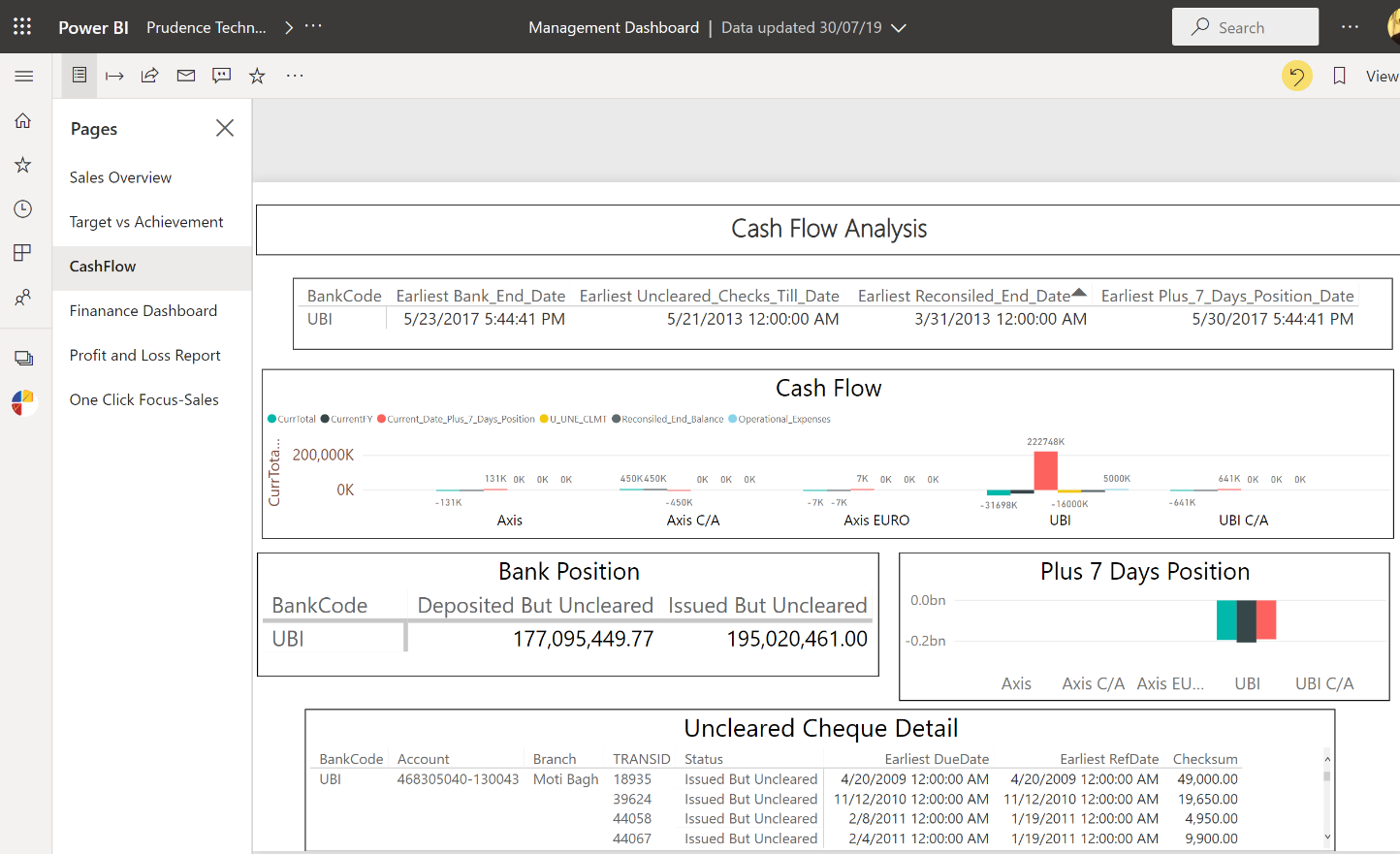

It’s important to cover every aspect of a business and specifically highly ignored areas like, “strong financial management”. It’s critical for an organization can analyze its cash flow position and plan accordingly.

Discover how proven methodology can help the organization streamline their fund planning and manage the cash flow. These parameters /indicators can be dynamic organization wise and since they convey a holistic picture give an accurate forecast. Discover how you can prepare your financial budget to prepare yourself.

The noted advantage of managing a cash flow can be:

- Forecast your profits and cash requirements

- Plan, how much loan is required, when and for what period

- Determine financial strength by drilling customer wise.

With Power BI, organization can make decisions on the basis of the data availability in a secured and approachable environment. Hence eventually helps top executives to make the decision or be informed to plan for the adversity.

Key Business Indicators:

- Cash/Bank Status

- Reconciled End Balance

- Available CC Limit

- Booked Invoices (To be realized immediate)

- Reconciled Bank & Bank End Date

- Operational Expenses

- Plus 7 Days Position

- Current + Plus 7 Days Position

- Plus 7 Days Cheque Issued

- Deficit Operating Amount

Key Business Benefits:

- Deficit Operating Amount

- Plus 7 Days Position

- Current + Plus 7 Days Position

- Plus 7 Days Cheque Issued

- Consumption of CC limit

For more information kindly contact us now at +91 958-299-9927. You can also write to us for a FREE demo at marketing@prudencesoftech.com